As Benjamin Franklin famously said, “In this world nothing can be said to be certain, except death and taxes.”

Consistent with his pre-election promises, President Joe Biden has proposed several tax increases on upper-income individuals, capital gains, and corporations. The initial proposals are intrinsically negative for U.S. equities and capital formation in general. However, it is unclear to what extent these proposals will need to be debated to turn into legislation as well as the timing of their enactment.

According to MRB Research, the key points of the tax plan are:

- Raise the federal corporate tax rate to 28% from 21% (it was 35% before 2018), establish a minimum tax rate of 15% on book profits (i.e., reported profits), and raise the minimum tax on select overseas profits to 21% (from 10.5%).

- Restore the maximum federal tax rate on personal incomes to 39.6% from 37% for annual earnings over $400,000.

- Increase the long-term capital gains and qualified dividends tax rate to 39.6% from 20% on annual incomes above $1 million.

Preserving support from Democrats ahead of the mid-term elections in 2022 may be difficult, and we expect political posturing to drive negotiations and headlines over the next few months. Of course, the devil is in the details.

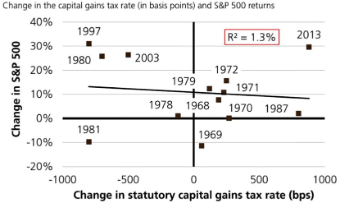

The long-term relationship between income, capital gains and corporate tax rates and economic growth and equity market returns is mixed. The UBS and FactSet data below illustrate a low correlation of 1.3% between changes in S&P 500 returns and the capital gains tax rate:

Looking back in history, declining tax rates did coincide with stronger economic growth and equity price gains in the 1980s. The tax cut on income indubitably drove flows into stocks and stock funds. Nonetheless, the most important drivers of economic growth and financial asset price gains in the 1980s was the decline in inflation and interest rates that had undermined economic and equity market performance in the 1970s. Corporate earnings and stock prices have enjoyed historically strong gains over the past 30 years since then.

Over the long run, market returns move to the tune of earnings growth/momentum, the cost of capital, and real economic growth, etc. Yes, equities tend to consolidate and decline in the run-up to a tax hike and yes, a capital gains tax hike could provide a tailwind for selling appreciated assets in 2021. Some investors will sell now versus later. This will bring forward some selling to minimize the tax impact and potentially create a drag on highly appreciated equities, although the downside effects are expected to be minimal and limited. However, the ultimate impact of the tax proposals on the U.S. equity and capital markets will depend primarily on the long-term economic outlook and corporate profits cycle.

Finally, while we are not tax experts and would defer any tax advice to your CPA, we can highlight a few points for investors to consider:

- Increase tax efficiencies and diversification

- Donate stocks to charity

- Increase tax-free income

- Harvest tax losses and defer capital gains

- Pick the right location for assets

- Accelerate lifetime gifts

If you have any questions or want to have a conversation about the market or your portfolio, please contact Liz, Ed, Fred, Scott, Tyler, or myself. Your Sendero team is ready to help.

Best Regards,

Amaury de Barros Conti

210-930-9409

aconti@sendero.com