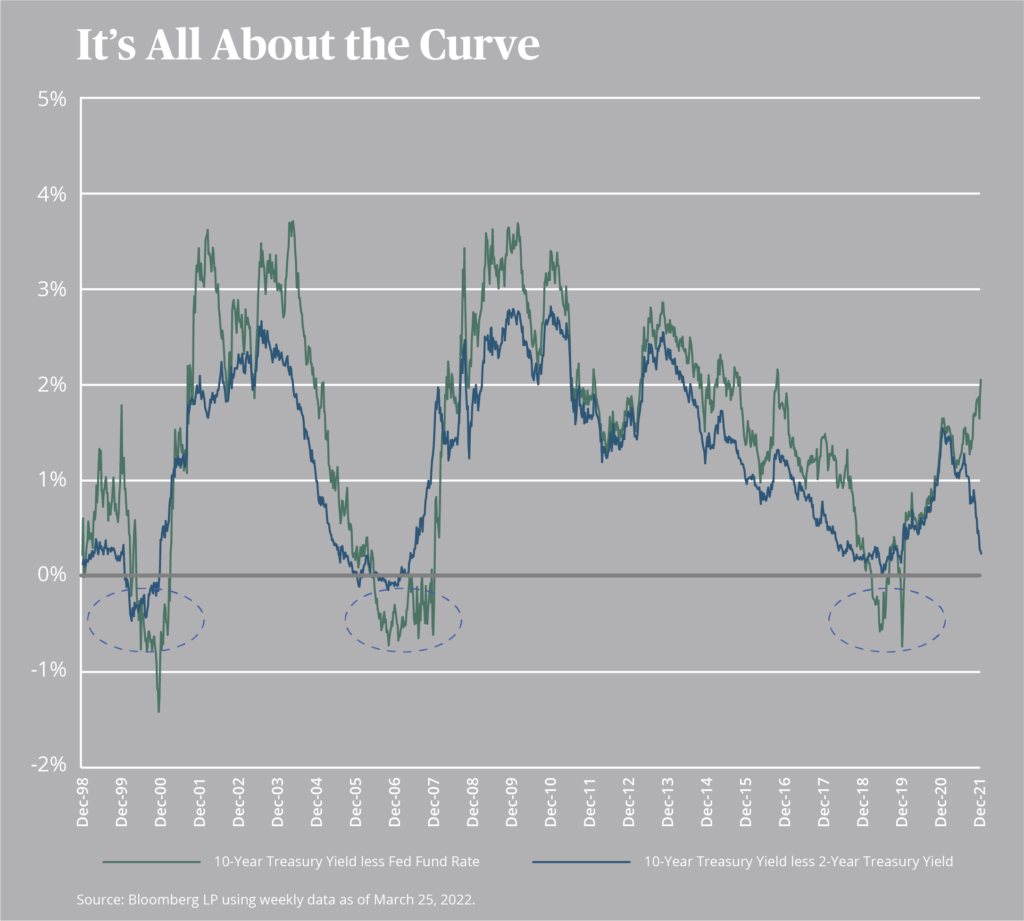

Now that the Fed has raised rates, investors are looking at the (Treasury) curve for an indication of what’s next for the economy. Historically, the spread between 2-Year and 10-Year Treasuries, known as the “2-10 spread”, has commonly been used to forecast potential recessions when it goes negative. However, given the current inflationary environment, a better way to gauge economic activity is to look at the spread between the Fed Funds rate and 10-Year Treasuries. Even with expectations for the Federal Reserve to continue raising the Fed Funds rate in 2022, that spread is still very much positive!