August is a pivotal month for those who have worked diligently to build and steward family wealth. As summer travel winds down and preparations for a new academic year take shape, it’s an ideal time to step back, reflect, and ensure that your wealth strategy is resilient, intentional, and aligned with your family’s values and vision. In this article, we will examine how to capitalize on opportunities, address uncertainties, and reinforce your family’s legacy.

Why August Is Important

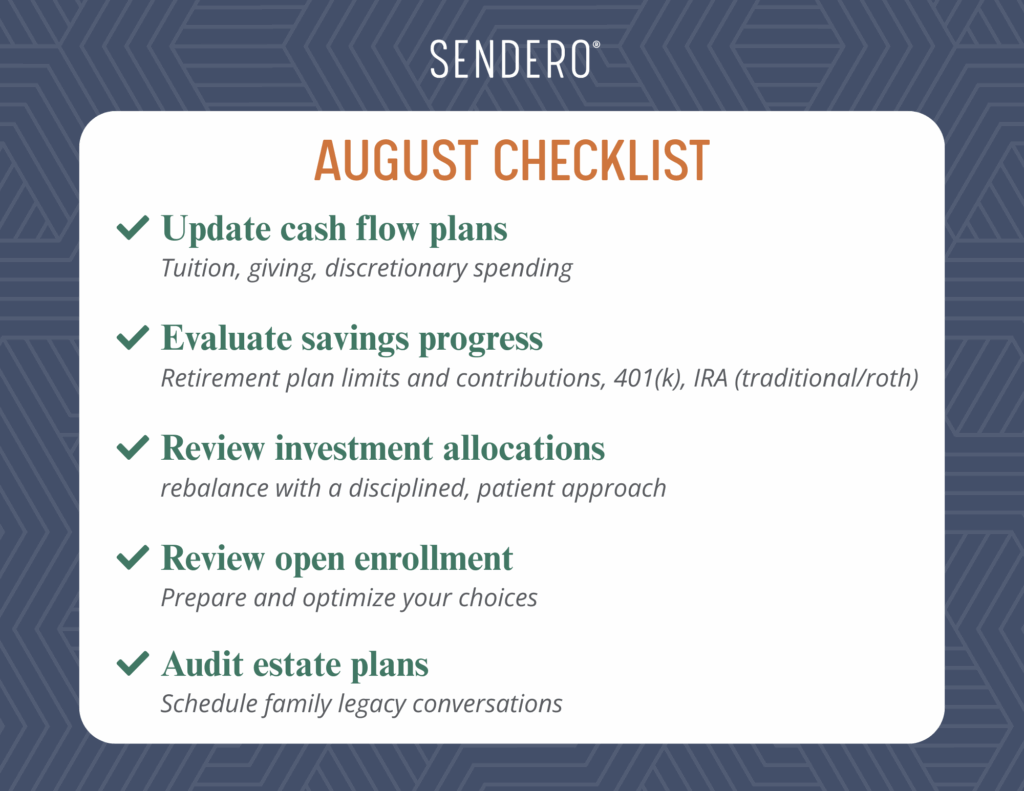

- Cash flow considerations around tuition payments, philanthropy, and discretionary expenses can affect financial plans.

- Summer spending patterns offer a chance to assess discretionary outlays and realign priorities.

- Proximity to employee open enrollment signals the need for benefit reviews and optimization.

- The second half of the year is critical for proactive tax, estate, and investment planning.

Key Actions for August

1. Review Spending and Cash Flow

- Assess recent spending on major items: private education, travel, and charitable contributions.

- Adjust short- and long-term cash flow projections for tuition payments, family support, and future philanthropic goals.

- Reallocate excess cash to donor-advised funds, investment structures, or trusts, if aligned with your intentions.

2. Reassess Savings and Contribution Strategy

- Review progress on annual savings targets across taxable, tax-advantaged, and family trust accounts.

- 2025 Retirement Plan Limits:

- 401(k):

- $23,500 max if under 50;

- $31,000 for ages 50–59 or 64+;

- $34,750 for ages 60–63 (if your plan allows catch-up).

- IRA (Traditional/Roth):

- $7,000 if under 50;

- $8,000 if 50 or older.

- 401(k):

- Evaluate advanced opportunities such as non-qualified deferred compensation, backdoor Roth IRAs, and defined benefit plan contributions.

- If you are behind in funding, consider increasing transfers, leveraging tax-loss harvesting, or revising asset locations. If you are ahead, explore multi-generational gifting or supplementing 529 plans for heirs.

3. Optimize Investment Strategy Amid Volatility

- Collaborate with your advisors to conduct an in-depth portfolio review, ensuring you are in alignment with your mission, risk levels, and multi-generational objectives.

- 2025’s heightened market volatility, driven by global events and economic policy shifts, requires vigilance when reviewing asset allocation drift. The Volatility index (VIX) has shown pronounced fluctuations, making disciplined rebalancing vital this year.

- Weigh the benefits of rebalancing against transaction costs and tax impact, especially for illiquid or alternative investments.

- Assess the performance and liquidity of private equity, hedge funds, and real assets.

- Revisit allocations after large liquidity events—like business sales or significant family changes—that can skew your risk profile.

4. Prepare for Employee Open Enrollment and Executive Benefits

- Collect information on executive compensation plans, supplemental insurance, and other unique benefit options to ensure you are maximizing your options.

- Re-examine health, life, and disability coverage given any changes in family structure or net worth.

- Work with advisors to capture advantages from HSAs, FSAs, and specialized employer benefits.

5. Strengthen Estate and Legacy Planning

Consider scheduling a family meeting to discuss or reaffirm legacy plans and create open communication across generations.

Review and, if needed, update estate documents—wills, trusts, health directives, and powers of attorney—to reflect recent family or legislative changes.

Secure both physical and digital copies of vital documents; ensure your trusted family and counsel have easy but secure access.

Conduct an inventory of all accounts, real estate, and private investments, streamlining where possible.

Disclaimer: The content in this article is provided for informational purposes only and should not be relied upon as recommendations, or financial planning advice. We encourage you to seek personalized advice from qualified professionals regarding all personal finance matters.