We are returning to the office! While some of us have already been in the office for the last few months, we are safely getting all the teams back in person over the next few months.

As I ditch my pajama pants for more formal wear, I realize my commute to the office offers a window into how our local economy is recovering. People are busy! Restaurants, shops, and weekend sporting events are back.

Yes, the productivity gains from 2020 will ebb, but the ability to catch up with the rest of the team face-to-face brings back comradery and transfer of knowledge. Zoom and Teams meetings still have their place in the work environment. But collaboration and tacit communication still transpire best in person.

Returning to the office is certainly not unique to Sendero. Conversations and anecdotes from managers and friends confirm this. The effect on the market is evident.

We have highlighted before how the upcoming economic data could look very strong: 2021 GDP expectations have moved up to over 6% — and even as high as 8% — the strongest since 1984 potentially. March retails sales climbed to 9.8% , the second highest reading in the series’ history. Along with the economy reopening, inflationary pressures due to supply chain constraints and higher commodity costs are impacting our daily lives, as was recently highlighted on the “Today” show.

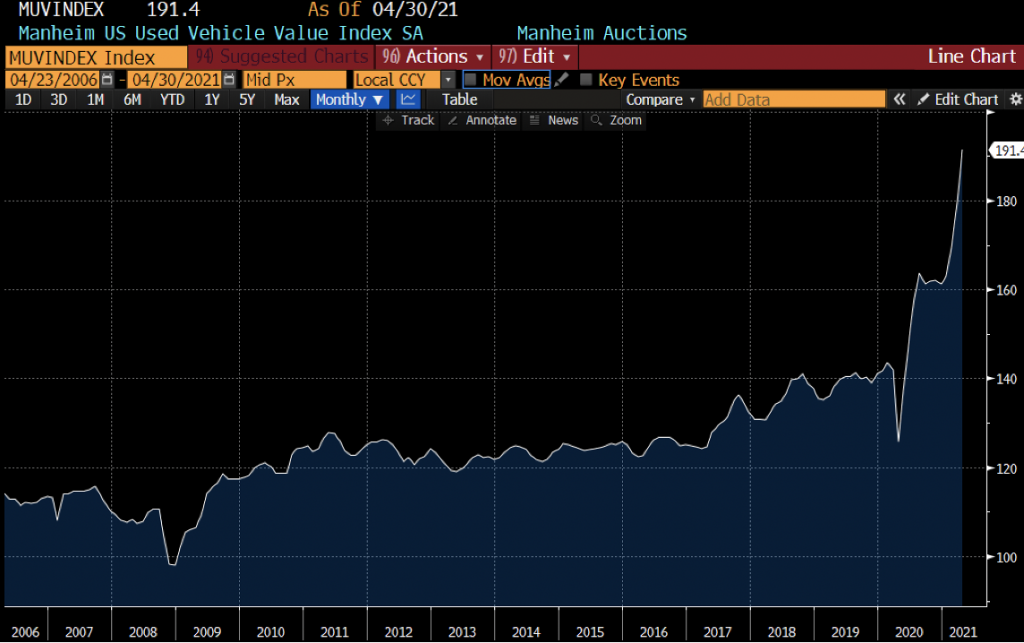

While not having to commute for almost a year helped to save on gas and miles put on my car, returning to the office became an occasion to discuss used and new cars. The low new car inventory and shortages of chips and other parts have fueled a surge in used car prices (see chart below):

As investors, we continue to take in all these new inputs to formulate how to position portfolios going forward. We have introduced inflation strategies to help mitigate the risks of losing purchasing power in our fixed income or Stability allocation, while examining the entirety of the portfolio.

A recent point of discussion has been around real estate. While price dislocations did not happen last year to the extent we expected, the pandemic has accelerated some trends around the office and housing sectors. Parts of this asset class have recovered, and others may take longer. The structural nature and valuation dispersion between real estate assets may present an opportunity and warrants more research.

Technology has certainly enabled most of us to persevere in 2020. Yet, the demise of the office may have been exaggerated. I look forward to sitting around our kitchen table and chat once again about the best Tex-Mex restaurant in town.

If you have any questions or want to have a conversation about the market or your portfolio, please contact Liz, Ed, Fred, Scott, Tyler, or myself. Your Sendero team is ready to help.

Best Regards,

Amaury de Barros Conti

210-930-9409

aconti@sendero.com