I. What Moved Markets Last Week

- U.S. stocks closed the holiday-shortened week to mark four consecutive weeks of gains. Trading volumes were light. For the week, the Dow gained 1.3%, while the S&P 500 advanced 1.0%, and the Nasdaq Composite tracked 0.9%, as per Bloomberg data.

- All Federal Reserve officials agreed to “proceed carefully” with interest rates, according to the minutes from the FOMC’s latest policy meeting. Members want rates to stay restrictive “for some time,” as inflation remains above the 2% objective, with virtually no indication of cutting rates anytime soon.

- Data compiled by Bloomberg showed U.S. investment-grade corporate bond spreads have breached a level not seen since 2022 as investors bet the Federal Reserve has reached the end of its rate hiking cycle. The figure, which measures the extra yield investors demand to own corporate bonds instead of Treasuries, stands at its lowest level since April 2022.

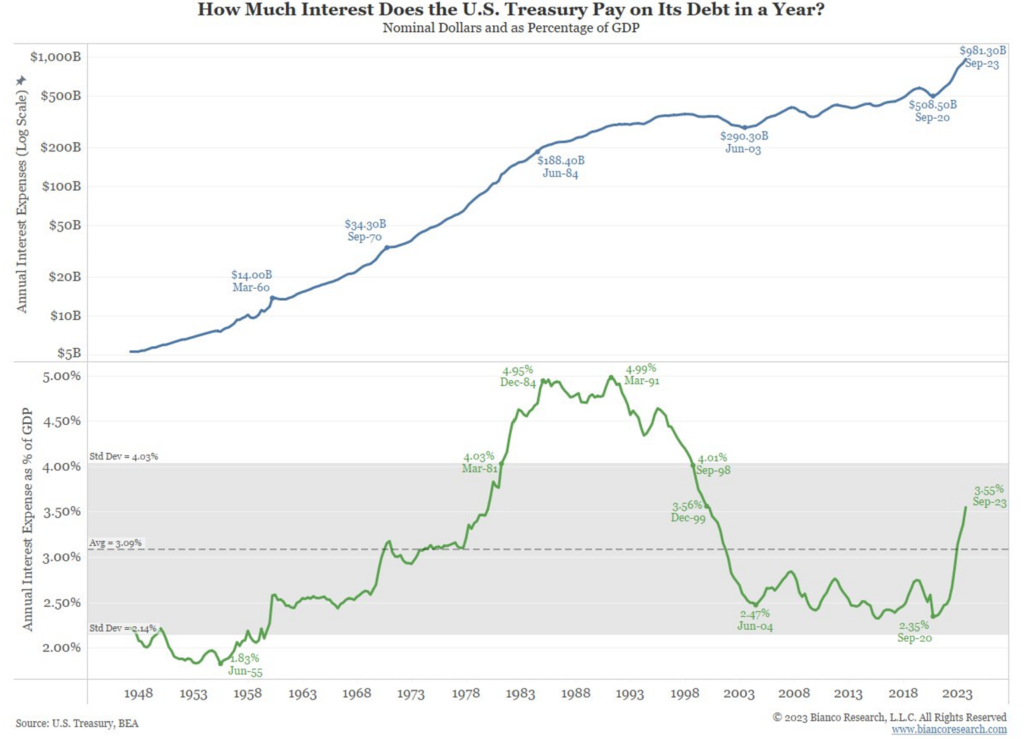

- A great chart from Bianco Research illustrated that the Federal Government is required to pay $924 billion in interest expenses on its debt, the highest interest expense as a percentage of GDP since December 1999.

II. Looking Ahead

- Energy traders will be tuned into the delayed OPEC+ meeting amid reports of disagreements among members over how much production to cut. Crude oil futures have steadied over the last week in front of the OPEC meeting but are down more than 10% over the last six weeks.

- Key economic reports include updates on new home sales, consumer confidence, construction spending, and the latest reading on the Federal Reserve’s favorite inflation gauge. The PCE reading on core inflation is expected to show a 0.2% month-over-month and 3.5% year-over-year increase. It should confirm the ongoing moderation in consumer price inflation shown by October’s CPI and PPI reports.