Compound interest is a powerful tool in investing that builds wealth overtime. In this article, we will explain what compound interest is, how it works, and why it is important to start investing early.

What is Compound Interest?

Compound interest is the interest that is earned not only on the principal amount but also on the accumulated interest. In simple terms, it is the interest you earn on the interest you have already earned. Unlike simple interest, which only earns interest on the principal amount, compound interest allows your investments to grow exponentially over time.

How Does Compound Interest Work?

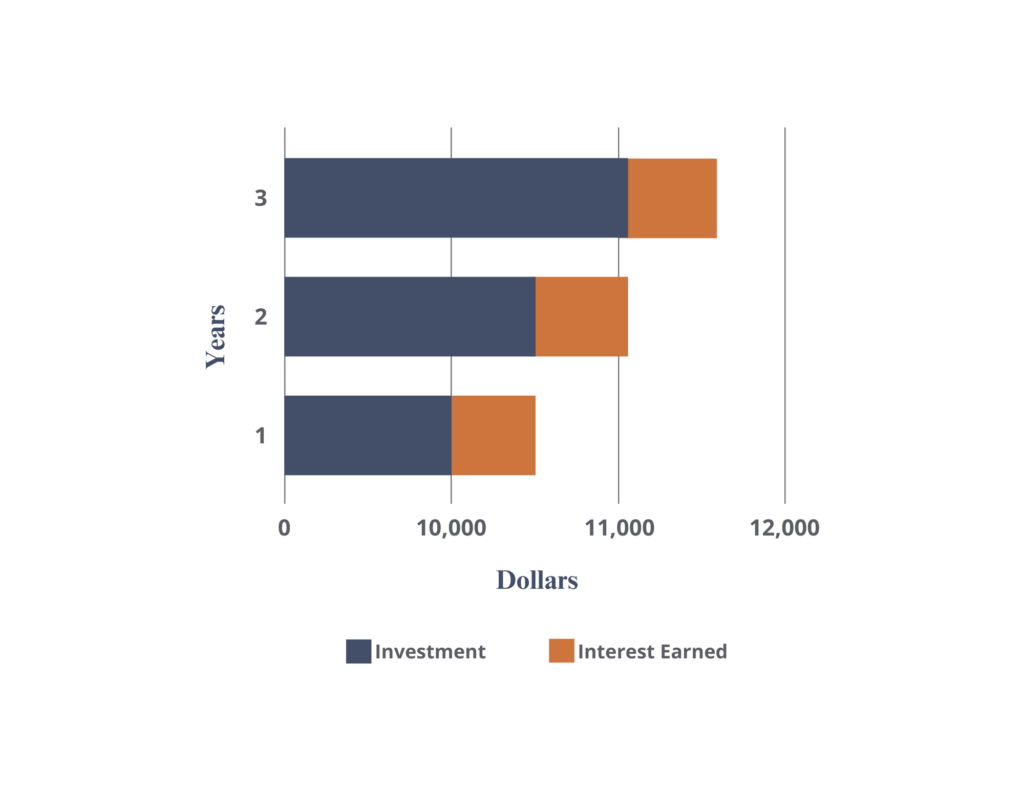

To understand how compound interest works, let’s consider a simple example. Suppose you invest $10,000 at an interest rate of 5% per year. After the first year, your investment would be worth $10,500, including the $500 in interest earned. However, if you reinvest the $500 back into your investment, your new principal balance would be $10,500, and the interest earned in the second year would be calculated based on that amount. This process continues year after year, leading to exponential growth in your investment.

Why is it Important to Start Early?

The power of compound interest lies in time. The longer you allow your investment to grow, the more significant the impact of compound interest will be. The earlier you start investing, the more time you have for your investment to compound and grow exponentially.

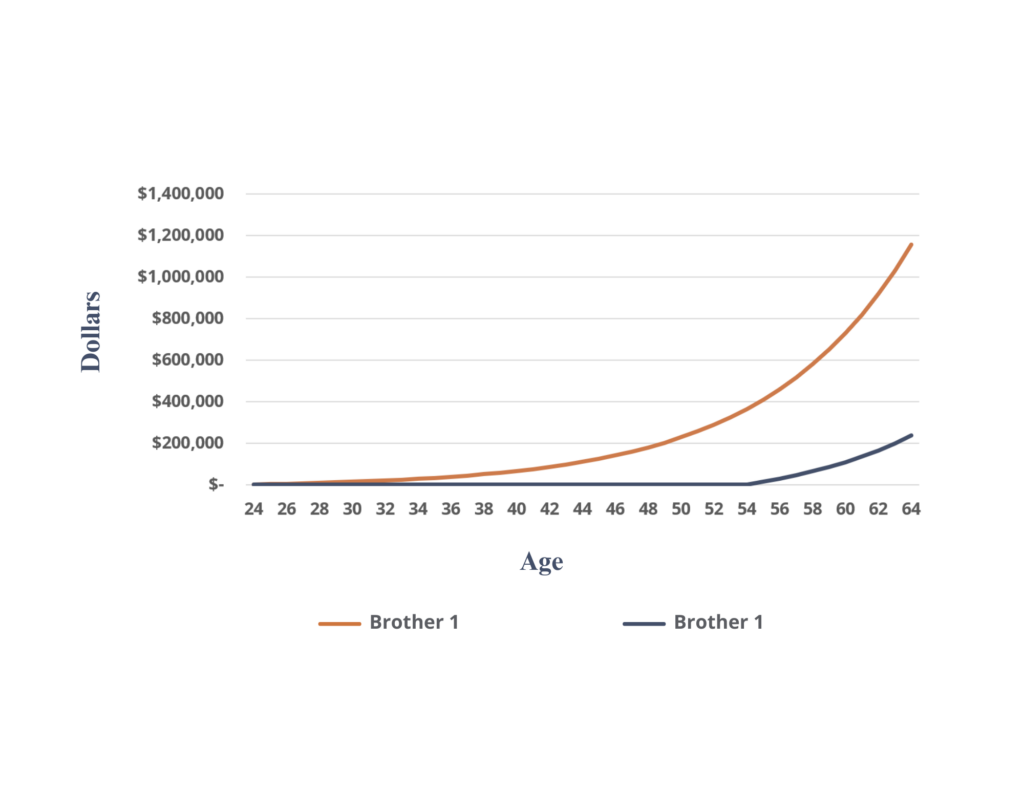

A popular — and completely hypothetical — example involves two brothers investing $100 each month starting at age 25. Brother 1 averages a 1% positive return each month, compounded monthly over 40 years. Brother 2 invests $1,000 a month but doesn’t start until 30 years later, and they get the same positive return over 10 years.

After 40 years, Brother 1 has $1.15 million while Brother 2, who invested more each month, has $235,855. Early and consistent contributions will yield higher returns once it’s time to retire.

Compound interest is a powerful tool and can help you build wealth overtime. By reinvesting your interest earnings, you allow your investment to compound and grow exponentially. Starting early gives you the advantage of time and allows you to benefit from power of compound interest.

Sources:

“What is Compound Interest?” The Balance, accessed May 4, 2023, https://www.thebalancemoney.com/compound-interest-4061154

“The Life-Changing Magic of Compound Interest,” Forbes, accessed May 4, 2023, https://www.forbes.com/advisor/investing/compound-interest/

“The Power of Compound Interest,” Investopedia, accessed May 4, 2023, https://www.investopedia.com/terms/c/compoundinterest.asp

“Aligning Your Philanthropic Operating Model with Your Goals”, Harvard Business Review, accessed May 4, 2023, https://hbr.org/2023/01/aligning-your-philanthropic-operating-model-with-your-goals

Disclaimer:

The content in this article is provided for informational purposes only and should not be relied upon as recommendations or financial planning advice. We encourage you to seek personalized advice from qualified professionals regarding all financial decisions.