How This Happens

Every year, Congress must pass budget legislation for the next fiscal year by October 1st, consisting of 12 appropriation bills. Congress currently has not yet enacted any of the 12 bills that make up the discretionary spending budget for FY2024, meaning that a shutdown after September 30th is a real possibility once again. Alternatively, a “continuing resolution” can be approved to provide temporary funding at the start of the fiscal year allowing government entities to remain operational until a new spending budget is approved.

The “Fiscal Responsibility Act” (FRA) Congress passed in June 2023 to raise the debt limit should have ended the debate on spending levels. However, several policy issues will likely slow spending legislation and potentially stall it altogether. These issues range from international policies, such as funding for Ukraine, and ongoing domestic issues impacting the border.

Market Implications

Under a government shutdown, a decrease in economic activity may result in a hit to consumer confidence due to the uncertainty. Averaging past shutdowns, each day the government has been closed has reduced consumer confidence by 0.25 points, according to the Committee for a Responsible Federal Budget. Given the historically modest long-term impact on the economy and equity market, a government shutdown should also have little effect on current monetary policies. In the 2018 shutdown, Congress funded the Department of Labor but not the Department of Commerce, leading to delays in some releases (i.e.: retail sales, etc.). Several government offices were closed, including parts of the Internal Revenue Service and the Securities and Exchange Commission. However, the military remained open, thanks to a resolution passed earlier in the year.

Because a government shutdown impacts discretionary spending, work performed by federal employees decreases, which is labeled as a drop in federal consumption. Nonetheless, federal government employees did continue working, with roughly 800,000 (53%) employees furloughed without pay due to the 2018 shutdown. Federal government employees were initially denied wages, although they did receive back pay once the budget was approved. Other impacts may include delayed agricultural reports from the U.S. Department of Agriculture and the closures of national parks and museums.

How Markets Have Reacted in The Past

Prior shutdowns have occurred due to disagreements on the level or distribution of spending, or a dispute over extraneous issues that one party wants to address in the spending legislation. Since the 1990s, there have been four shutdowns of more than one business day, lasting an average of 14 days and hitting economic growth by an average of 0.16%. In each instance, the direct hit to overall GDP was mitigated by the fact that some agencies already had funding.

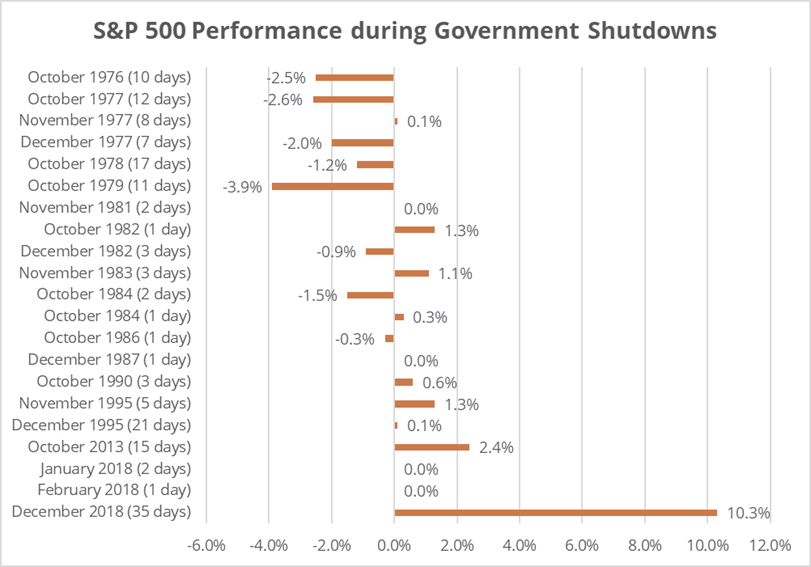

While a few individual stocks with a high percentage of their revenues from the government may underperform during a shutdown, investors have historically taken shutdowns in stride. At the end of each prior government shutdown, equity markets were flat or higher than at the start of the shutdown, though in each instance they were at least briefly lower at some point right after the shutdown began. The dollar also weakened slightly, along with 10-year Treasury yields ending lower during periods of shutdown. As the graph below shows, the mean S&P 500 performance during government shutdowns since 1976 is +0.1%. Excluding the most recent 2018 shutdown, the mean is -0.4%.

Conclusion

There have been near misses and more false alarms than actual shutdowns, each [each what? Each shutdown or each near miss/false alarm?] with at least three of these ingredients: a thin House majority, dispute on spending levels, and potential complications from various political issues. When the House returns on September 12th, they will have 12 legislative days to pass spending bills, or more likely a continuing resolution. If the main controversy is the spending levels, there is a good chance that Congress could pass at least one continuing resolution to extend spending authority past September 30th all the way to early December.

While some market volatility in the near term may be expected, Sendero’s Investment Team is focused on current and potential quality managers who can navigate and take advantage of market opportunities going forward.