The S&P 500 index is down 3.6% so far in September (as of Sept. 20, 2021), holding true to its seasonal monthly weakness. The wall of worry for investors includes the economy slowing down (i.e., “peak growth” and inflation fears), Fed tapering and debt ceiling, China’s tech crackdown, and potential tax changes. While each one’s long-term impact on the market is singularly difficult to quantify, the combination is a headwind for short-term growth.

Analyst predictions about a potential hit to 2022 consensus earnings from higher corporate tax rates can be useful to forecast a year-end level for the S&P 500. However, the timing and impact to a specific sector and industry leave room to err. We know the effective corporate tax rate is much lower.

Recently, one strategist floated the opposite idea for the Fed to hike interest rates now and to start tapering later. While this is contrary to what most investors (and Fed presidents) are thinking, the idea is not completely crazy. It would bring some direction to the fixed income market, help investors starving for yield, and abate inflation fears. Why not? I know what you are thinking: Yes, stocks would not react well initially to the move, but the stock market hates uncertainty — this would alleviate that worry in a perverse way.

My final point is over the potential for higher capital gains taxes. The devil will be in the details. How negotiations will play out and how many taxpayers will be impacted ultimately are still up for debate. We also have mid-term elections next year. Unfortunately, given the current political climate, there will be a lot more noise.

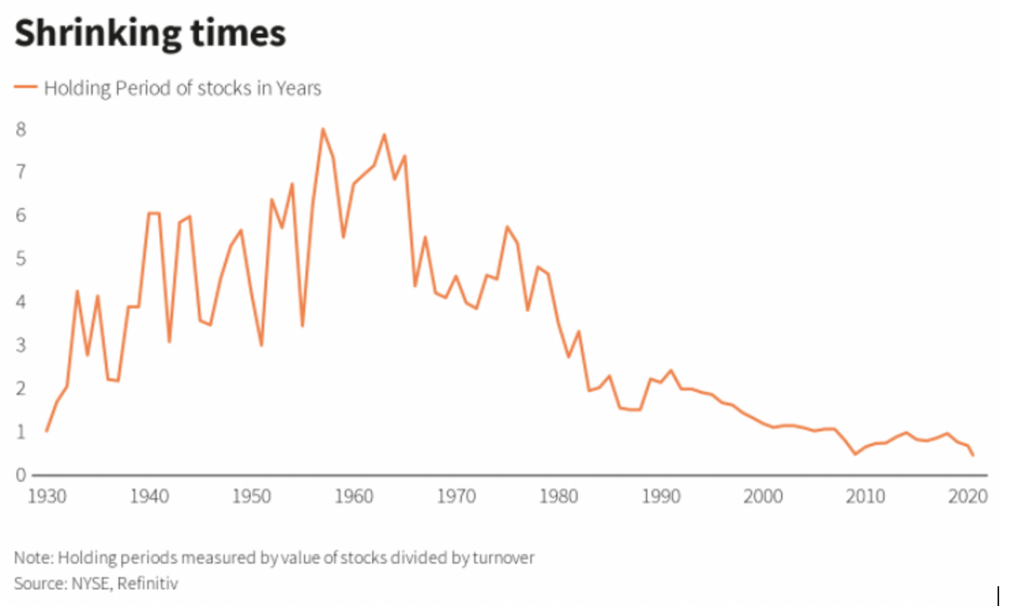

I can understand why an investor would decide to sell a stock now given this uncertainty versus selling in the future at a (potential) higher tax rate. Even with plenty of empirical evidence about the low correlation of tax rates and market returns, why do you have to sell that stock now if you were not planning in do so in the first place? Do not substitute a good investment for a mediocre decision. According to a 2020 study from MFS Investment Management, the holding period for NYSE-listed stocks was 5 1/2 months as of last June.

There are many reasons for the steady decline in holding periods: commission-free trading, zero percent interest rates, pandemic-induced volatility from day traders, algorithm-based machine trading by big institutions, etc. Warren Buffett’s favorite holding period — forever — has few fans these days it seems. Maybe an incentive to hold stocks longer than 12 months may drive market participants to act more rationally.

I acknowledge the simplicity of my arguments about taxes and how each investor situation is unique. In my case, I am putting money away every two weeks in a tax-deferred plan for another 15 years. I have no idea what the tax rate will be then, but I am not going to sell stocks in 2021. Even if I did, what would I buy? A 15-year U.S. Treasury bond yielding 1.5% does not sound like a good trade.

Certainly, tax location and planning matters. Changes in carried interest, step-up basis and lifetime exemptions are a lot more relevant to keeping your long-term wealth than worrying about short-term market noise.

If you have any questions or want to have a conversation about the market or your portfolio, please contact Liz, Ed, Fred, Scott, Tyler, or myself. Your Sendero team is ready to help.

Best Regards,

Amaury de Barros Conti

210-930-9409

aconti@sendero.com